ScoreFast™ with iMaaS™

Reinventing Customer Engagement with Predictive AI Models, Solutions, and Monitoring

It takes just minutes for our customers to connect to our service and get results. You can see your R/Python, TensorFlow models up and running with visualization of ingested data streams, and model scores delivered and documented and recorded over time.

Reinventing Customer Engagement with Predictive AI Models, Solutions, and Monitoring

ScoreFast™, is an award-winning predictive analytics platform that empowers the development, deployment and monitoring of AI applications in the Banking, Insurance and Healthcare Industries. The ScoreFastTM platform streamlines the development of predictive analytics applications across omni-channel deployments in the enterprise impacting business outcomes such as Increased Debt Collection, Improved Claims Processing, and Next Best Action.

The ScoreFast Platform can be used to monitor and manage complex AI models for data drift, score drift, and KPI drift each of which can help run A/B tests, eliminate biases, and comply with regulations, and thereby improve business performance.

ScoreFast-powered applications learn continuously (dynamic machine learning) thus eliminating the need for manual regeneration of predictive models delivering results with the lowest total cost of ownership. ScoreFastTM leverages cross-channel customer data, learns from it efficiently, and makes decisions that optimize long-term goals, such as customer lifetime value, customer experiences, and customer satisfaction.

Applicability to Cloud Contact Centers: By leveraging machine learning, ScoreFastTM enables agent empowered contact centers to deliver consistent customer experiences across all touchpoints in the omni-channel. ScoreFastTM-powered predictive applications have shown a 2-4x improvement over comparable legacy applications.

Product and Core Technology

ScoreFast™ Platform

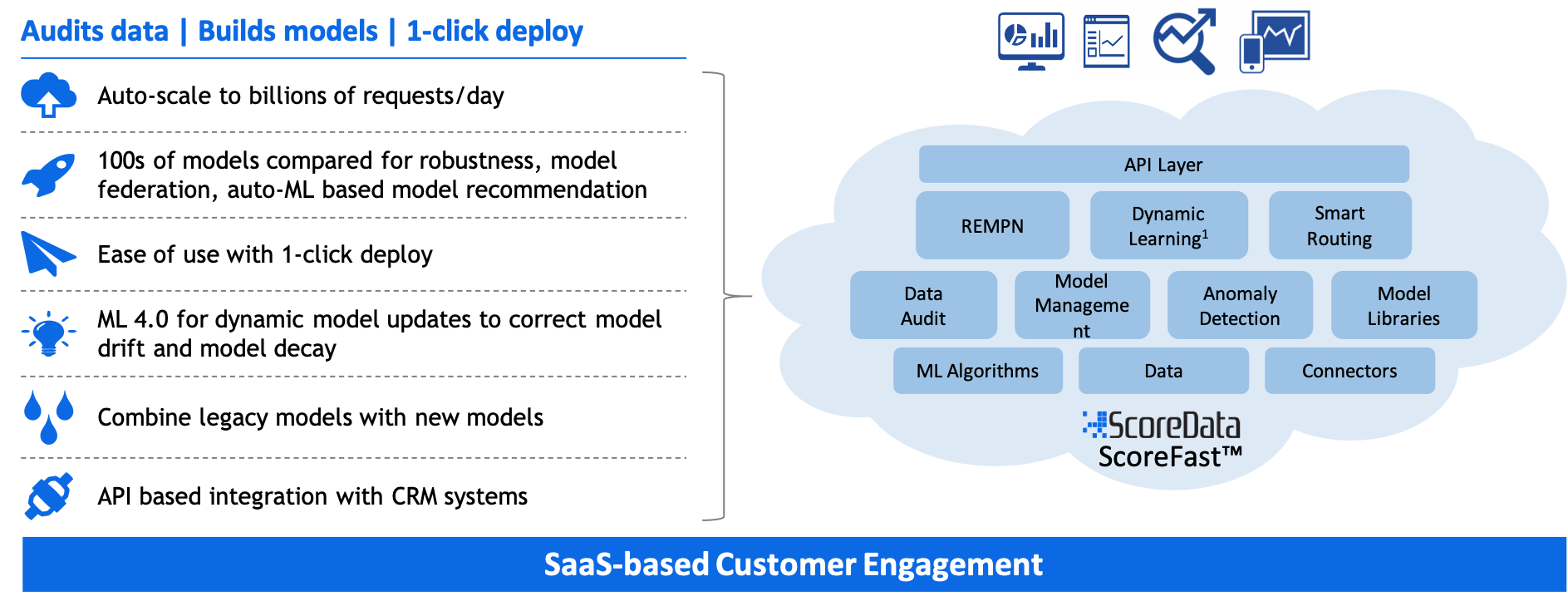

Audits data | Builds models | 1-click deploy

- Model Management, Monitoring, Compliance

- 100s of models compared for robustness

- Ease of use with 1-click deploy

- Auto-scale to billions of requests/day

- ML 2.0: Model Updates with Dynamic Learning

- API based integration with CRM systems

*Patent pending dynamic machine learning technology

Application Areas for Consumer Facing Industries

ScoreData enhances customer engagement in consumer facing industries – Banking, Financial Services, Insurance, Telecom, Retail, and Healthcare. Some of the applications built with ScoreFast’s predictive models are in:

- Agent Empowerment

- Customer Segmentation

- Churn management

- Cross-sell & Upsell

- Retention

- Fraud detection

“We had a manual process with fixed rules and spreadsheets that took six months to review. Using ScoreData’s robust churn models we can now reliably predict consumer programming preferences four weeks into the future with < 2% error rate. This will help us design better programs, and our advertisers deliver more targeted ads, to our consumers.”