Superior Collections With Predictive Analytics

A Customer Engagement center is a central point from which all customer contacts, including voice calls, chat, email, social media, faxes, letters, etc., of an enterprise are managed. According to the Head of a leading BPO that handles 9 percent of the world’s contact center traffic, over ninety percent of all engagement centers are driven by static rules-based systems. As customer information changes, these rules degrade, and new information is not leveraged quickly, resulting in poor customer experiences. These poor experiences further lead to lower customer satisfaction and decreased Net Promoter Scores (NPS), resulting in operational inefficiencies and lost revenue opportunities.

ScoreData’s ScoreFast™ platform uses historical internal and external data sets to build predictive models that help drive optimal customer-agent pairings. These predictive models simultaneously present agents with the most relevant engagement scripts that help the agent offer the most appropriate services and offers to customers. The resulting engagement helps improve the customer experience, while also ensuring that agents deliver the most optimal services to customers.

Satisfied customers lead to better NPS scores and these customers tend to be more open to cross-sell and upsell offers. All this can result in contact centers being transformed from cost centers to strategic profit centers. Getting the customer to the right agent at the right time also ensures enhanced contact center performance. With the large amounts of data collected by modern engagement centers, the possibilities of applying predictive analytics to improve engagement center efficiency and customer satisfaction are very many.

Thus, ScoreData’s solutions can be classified in the following categories:

- Enhancing Customer Engagement and improving customer experience. The possible applications include:

- Improved caller/agent matching

- Enhanced cross-selling and upselling

- Superior customer retention

- Interactive Voice Response (IVR) analytics

- Agent Empowerment

- Agent segmentation and ranking

- Agent performance measurement

- Dynamic script management

- Agent skills augmentation

- Workflow optimization and workforce management.

- Improved call routing and distribution

- Centralized global queueing

- Staffing optimization

ScoreData has extensive experience in building predictive models using the ScoreFast™ engine, many of which can be integrated with caller-business engagement scenarios, e.g., improved customer retention by churn prediction and mitigation, enhanced cross-selling and upselling, risk analytics, etc. This white paper is based on an optimization project undertaken with one of the largest contact center providers in the world. In this paper, we examine how predictive analytics will help contact centers of the future.

Engagement Center Optimization – Promise To Pay and Debt Collection Example

One of the biggest challenges for businesses is the need to work with their customers to reduce their levels of debt quickly and manageably – i.e., increasing Promise to Pay and maximizing debt collection. Research shows that more than 50% of people would switch to another provider if they experienced a bad debt collection processes. And, over 30% of customers would pay more promptly if they experienced good debt collection practices.

The objective for businesses then is to develop a strategy to maximize collection revenues and minimize operational costs through their engagement centers. This can be achieved by using predictive insights and machine learning technologies to profile customers and use these insights to devise an optimal strategy.

In legacy contact centers, on an outbound debt-collection campaign, the agents are typically assigned based on pre-defined, static rules. This approach does not take advantage of current customer profile information available as well as any past interaction data to connect the right agent to the right customer.

With ScoreData’s ScoreFast™ engine, we built predictive models using various data sources including customer, agent and interaction data to predict and match the customer to the right agent at a given time. These models are dynamically refreshed without manual intervention as the efficacy of the data degrades with change in data sources over time.

Promise to Pay

In this scenario, the objective is to maximize the number of customers agreeing to pay some amount of money to the debtor.

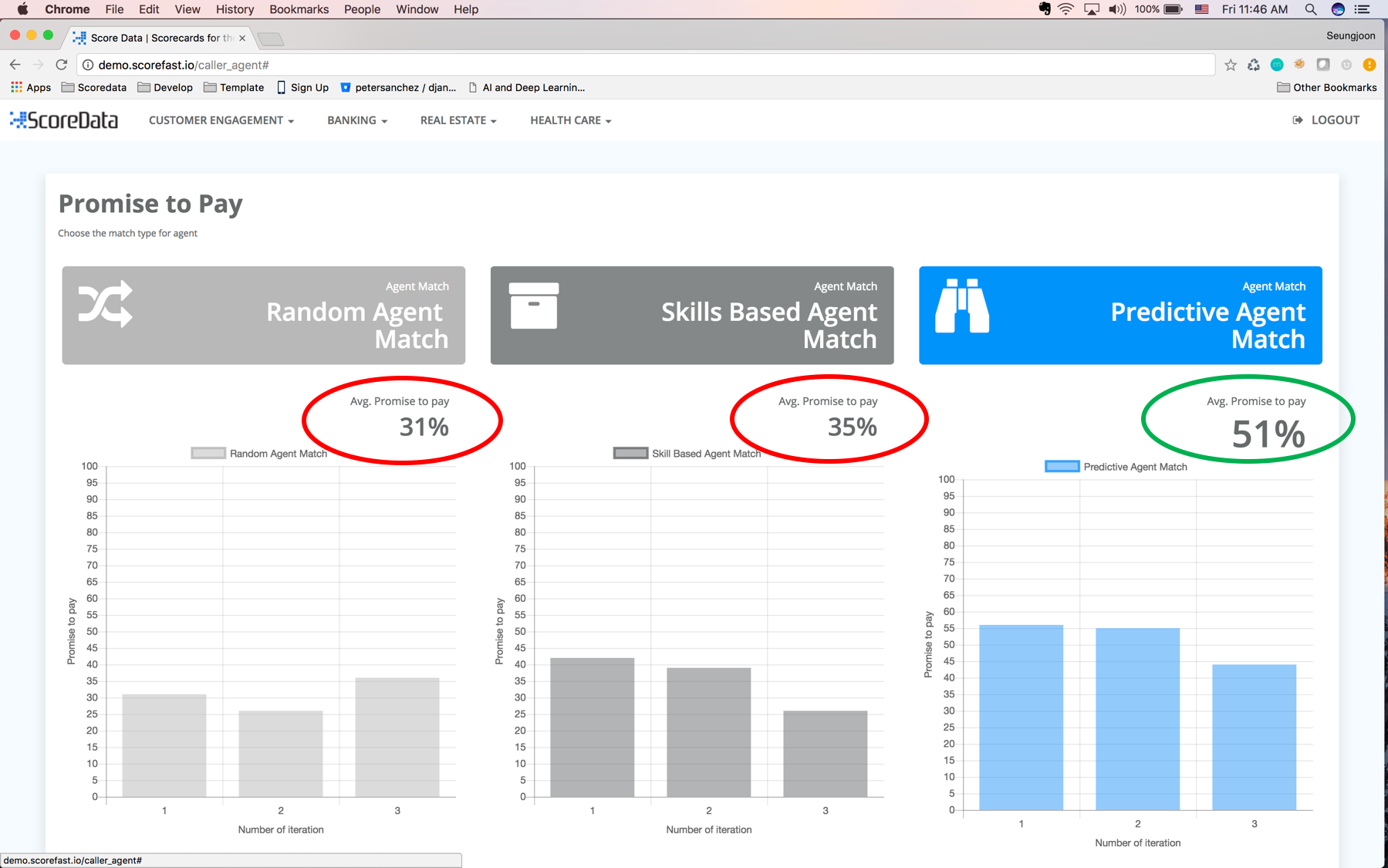

The chart below in Fig 1. shows the comparisons between various types of agent-customer matching including random match, skills-based match and a predictive match. With predictive match, there is a 45% uplift in promise-to-pay from customers.

Fig 1. Promise to Pay outcomes with various types of agent-customer match

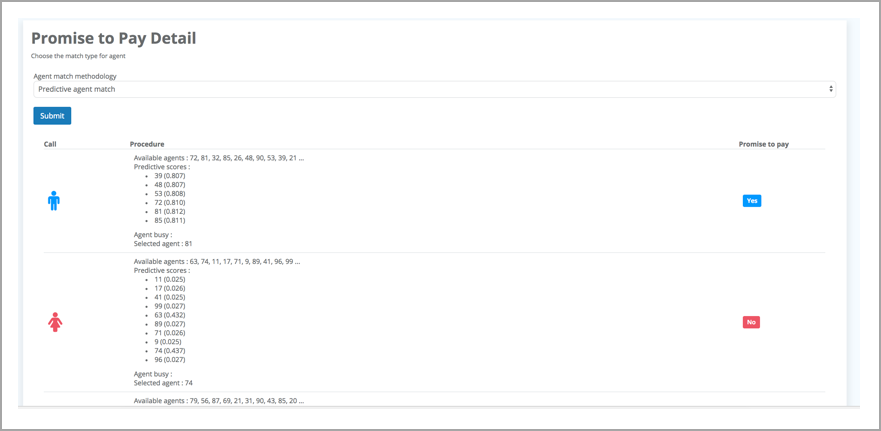

The Promise-to-Pay detail shown in Fig. 2 shows how the customers are scored and agents are selected. Note that this can change dynamically as the model learns new information about the customers, agents and caller-agent interaction data.

Fig 2. Promise to Pay with predictive match Detail

Debt Collection:

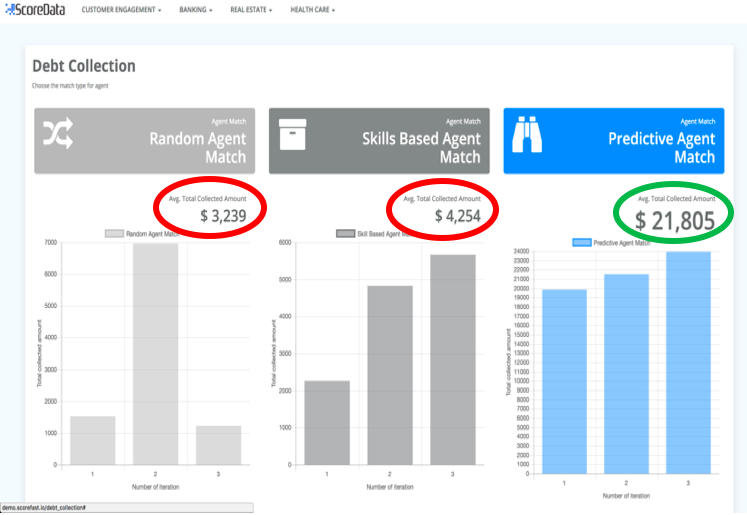

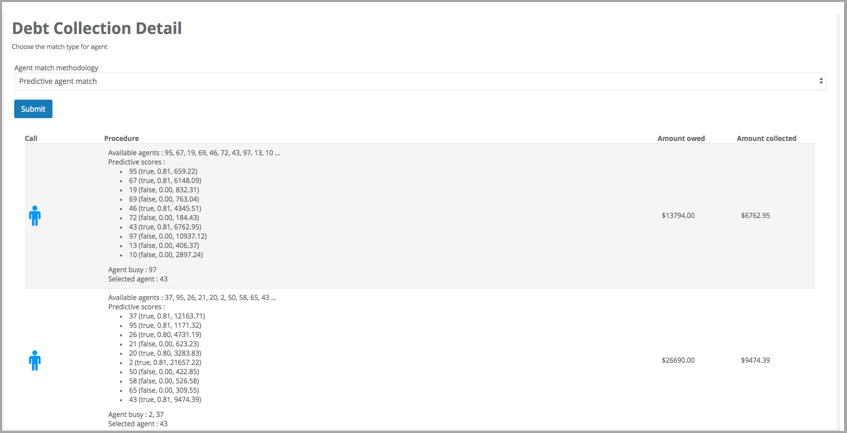

In this scenario, the objective is to maximize the amount of debt collected from the customers that owe the debtor. The outcomes with various types of agent matching approaches are shown in Fig 3. Multiple models were built and federated to achieve the objective below. This is shown in the Debt Collection detail in Fig 4.

Fig 3. Debt Collection outcomes with various types of agent-customer match

Fig 4. Debt Collection with predictive match Detail

How ScoreFast™ Makes a difference

Our models were built using the ScoreFast™ engine, leveraging web-based model development and management. It is built as an enterprise grade modeling system that can be used to develop a broad range of models for use cases inside and outside the Engagement Center.

The data and model management modules are easy to use, dashboard driven and intuitive. ScoreFast™ chooses models for specific use cases after trying out many algorithms internally and selecting the one with best performance metrics. ScoreFast™ has collaboration features encouraging sharing and collaboration within large cross functional teams, and access control features that are designed keeping in mind specific needs of ScoreData’s big enterprise clients. The collaboration features encourage cross-functional knowledge sharing and innovation within the companies.

The platform has built in hooks to link raw data feeds into the system and its one-push provisioning features mean models once developed and tested can be deployed onto downstream systems with a single push of a button. These features make ScoreFast easy to integrate into existing business processes without any disruption or cost overheads.

The canonical engagement center use cases deal with Agent Ranking, Caller-Agent Mapping, Dashboards with cross-sell or upsell with detailed presentation of customer profiles, and Engagement Center workload optimization. All these yield substantial improvements in customer satisfaction and improved top-line and bottom-line benefits. The ScoreFast™ engine delivers unique value throughout the predictive analytics insights-to-decision process, with a dramatically lower total cost of ownership.

Conclusion

In a world where new data sets are rapidly being created and are being made available for decision making, legacy systems are at risk of making decisions with outdated information. This is where ScoreFast™ can help with dynamic machine learning (DML™) and AI. Predictive data models built with ScoreFast™ will play a crucial role in helping businesses to rapidly adapt to the changing world. Customer Engagement Centers in general, and Contact Centers in particular, will cease to become Cost Centers. Rather, they will become profit centers that drive improvement in Customer Experiences and Net Promoter Scores.