Debt Management and Collection Analytics (Customer Segmentation)

Debt Management or Collection Analytics helps the debt collector or debt recovery processes to understand the behavior of customers, predicting their behavior after defaulting and prioritizes their collection activities to maximize their recoveries and reduce cost.

With the increasing competition in the lending business and services sector, collection functions of all companies across the financial business spectrum are feeling pressure to cut cost and become agile in adapting the changes. Even governments across the geographies are tightening the legislations to monitor those collection agencies from going overboard in collection efforts. The onus is on the collection functions of these companies to adapt to the changing market and legislative environment to increase efficiency and cut the cost. The application of analytics especially predictive analytics helps the companies to understand the causes of default and best way to maximize the collection at optimum cost.

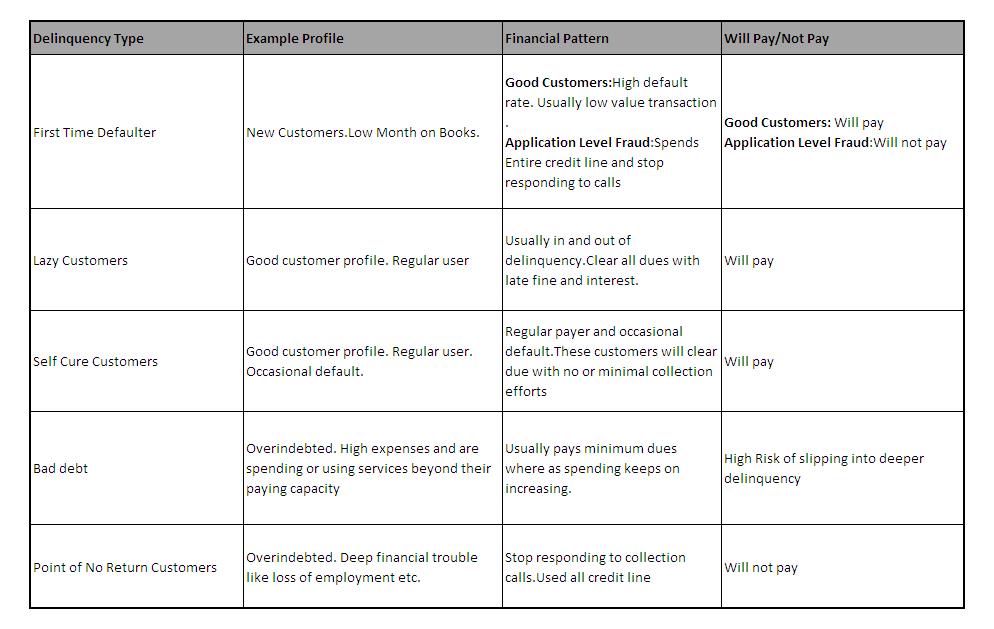

It is always better to understand the type and reason of delinquency from historic data and act proactively on the accounts showing similar type of characteristics. Based on the typical behavior, we at ScoreData divide customers into different segment and recommend differential treatment to each segment.

- First Time Defaulter: These customers are usually low month on books customers. The rate of default is usually higher in early vintage customers as they need time to get into habit of regular bill payment. Also collectors need to be aware of customers who have taken service with intention of Fraud. These customers will usually finish their credit limit and vanish. Our solutions treat early vintage customers separately and uses behavioral model to separate good and bad customers in early Month on Book customers.

- Lazy Customers: Lazy customers are those customers who are just lazy to pay or clear their dues at time. They are also referred “revolvers” because they keep revolving from delinquent bucket to current bucket (with no dues).These customers are very profitable for the companies because other that paying their outstanding dues they also pay interest and late fine quite regularly with minimal collection effort. It is very important for companies to identify these profitable customers are target them with better customer service or increasing credit limits etc.

Self Cure Customers : Self cure customers are those customers in collection who with no or minimal collection effort return to their current collection cycle. Every collection portfolio across the domain have “self cure segment”. Identification of the same helps the collection agency to save their collection budget for other segment. Usually self cure customers are those who have not used all of the available credit and are occasional delinquent.

Bad debt : These are those customers who have used their complete credit line and are in and out of delinquency. One of the common traits found in this segment is tendency to pay just the minimum dues. Bad debt customers are those customers who have taken loan or used services beyond their paying capacity. For these customers the credit score is observed to be deteriorating over recent months because these customers usually have some financial problem and they start defaulting everywhere .The chances are very high to for these customers to turn bankrupt if they slip into further financial mess. Collectors need to proactively identify these customers and act fast to recover their outstanding before they reach the point of no return. - Point of No Return Customers: These are those customers who are most likely to turn bankrupt and not going to pay anything despite any collection effort. Usually these customers are deep in dues and are non-responsive to any collection outreach. There may be variety of reason for such behavior like sudden loss of job, intention of fraud , divorces etc. Once the customer crosses point of no return he simple cannot or will not pay. Early identification helps the companies to limit the credit exposure to minimize the losses.

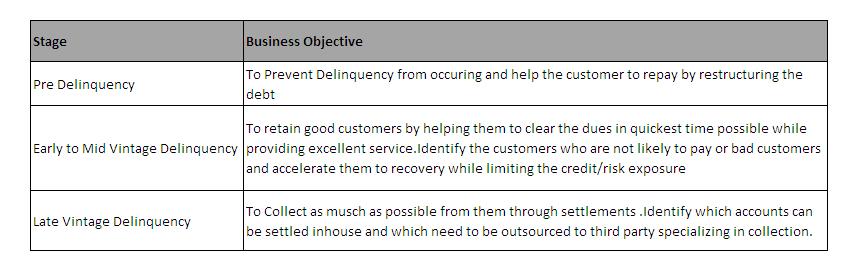

Traditionally collection process starts when the customers default in their regular payment. Usually different companies have different criteria to move customer from regular process to collection. But the customers start showing the sign of risk of slipping into arrears much before actually turning delinquent. Identification and treatment of such account is very sensitive as the customer has done nothing contractually wrong. This stage in collection is referred as Pre Delinquency Period. The focus in pre delinquency is the prevention of default. Secondly when a customer is actually delinquent and in early to medium stages (it varies from company to company), the focus of collection process is to find methods to make customer repay his outstanding arrears. This is referred as early vintage collection. When customer starts to ignore the request of repayment and becomes increasingly delinquent then the third and final stage is reached. This is referred as Late Vintage Collection portfolio. After this the company books the account as loss or charge-off/write-off. The business objective of each stage of collection is different.

Broadly analytical techniques that are used in predictive analytics can be divided into regression techniques and machine learning and regression techniques. Regression techniques includes linear regression, logistics regression , Discrete choice models, probit regression, time series models , survival or duration analysis etc. Machine learning includes neural network, MLP(multi layer perceptrons, Radial based functions, Naïve bayes etc.

The analytics solution of ScoreData lays emphasis on treating the customers at different delinquency level differently. Our predictive solutions segment the customers using their demographics, collection data based on their risk profile but also do analysis to find the most suitable treatment for each segment. We use predictive analytics to make accurate estimates of a customer’s propensity to repay, as well as the likely amount that the customer will repay. Our collections models help distinguish between self-cures and potential long term delinquent accounts only to maximize the collection from the delinquent accounts while preserving valuable customer relationship.